Posted: February 25, 2026

Wharton Stories

Finding the Intersection of Data, Capital, and Purpose

Wharton Stories

CarboWells Wins 2026 Y-Prize

CarboWells is the recipient of this year’s Y-Prize competition, cosponsored by the Mack Institute for Innovation Management and Venture Lab in partnership with Penn Engineering and the Penn Center for Innovation. The team includes Wharton undergraduates Yash Iyer, W’29, and Bhuranyu Mahajan W’29.

CarboWells is the recipient of this year’s Y-Prize competition, cosponsored by the Mack Institute for Innovation Management and Venture Lab in partnership with Penn Engineering and the Penn Center for Innovation. The team proposed a 3D-printed concrete well plug that captures carbon and is designed to reduce failure rates in abandoned oil and gas wells.

There are an estimated 2 million abandoned wells across the United States, including roughly 350,000 in Pennsylvania. These wells can leak methane and other harmful gases, contaminate groundwater, and contribute to climate change. While federal and state governments have committed billions of dollars to plugging wells, traditional concrete plugs can crack and degrade over time, leading to costly repairs and continued leakage.

CarboWells was awarded a $15,000 grand prize after presenting its business plan, and fielding questions from a panel of judges from academia and industry. The team includes Wharton undergraduates Yash Iyer, W’29, and Bhuranyu Mahajan W’29.

To read more, click here.

Posted: February 20, 2026

Wharton Stories

Sharing the Journey: Why This Couple Chose Wharton’s EMBA Together

“Doing this program together elevates the entire experience and the value we take away,” says Rohit Chawla, WG’27.

For married couple Ananya Gutta, WG’27, and Rohit Chawla, WG’27, pursuing an Executive MBA wasn’t just a career decision. It was a shared life choice.

“We knew an MBA was something we both wanted,” Ananya says. “The question was whether we would do it separately or together.” They chose together.

Parallel Paths, Shared Ambition

Ananya and Rohit grew up in New Jersey, and met during their undergraduate years at Rutgers University where they pursued engineering and economics degrees. Their careers followed parallel paths into the medical device and life sciences industries, each moving from technical engineering roles into product management and increasingly strategic leadership positions.

Rohit began his career at a startup, wearing multiple hats across R&D, product development, and venture funding before joining larger organizations including Stryker and Smith+Nephew. Today, he is the global director of product management and innovation at Alcon, where he defines portfolio strategies and drives growth.

Ananya’s path took her through Thermo Fisher Scientific, where she rotated through their operations leadership development program before transitioning into product management and the medical devices space at Medtronic and then Alcon. Now as a global director of product management, Ananya leads the upstream strategy for IOL delivery systems used in cataract surgery.

As they both aspire to be in global general management roles, the need for broader business knowledge became clear, and they began looking at EMBA programs.

Wharton stood out immediately.

For Ananya, Wharton’s strength in healthcare management and the depth of its alumni network were major draws. “You’re learning alongside people from every industry with incredible experience,” she says. “And Wharton doesn’t dilute the EMBA experience; you still experience Wharton’s rigorous curriculum and high standards of the full-time MBA.””

Rohit saw Wharton as a long-term investment. “This is a huge time and financial commitment,” he says. “If we were going to do it, we wanted to do it at a top school. Wharton’s world-renowned faculty, global brand, and access to an incredible network made it the clear choice.”

Timing It Together

For the couple, doing the program together was about alignment.

“An EMBA is incredibly time consuming,” Ananya says. “If one of us did it first, that person would be completely absorbed, and then we’d switch. Doing it together meant we were busy — but busy together.”

They study together, commute from Texas to Wharton’s Philadelphia campus together, and take classes together. “After school started, we also started working at the same company. Our lives were becoming increasingly intertwined,” Rohit says. “It feels like we’re walking in stride.”

Expanding Their Network

Although they share the EMBA experience, Ananya and Rohit have been intentional about building their own relationships across the MBA program. Each has formed connections, and then introduced those networks to one another.

Both say the greatest value of the Wharton EMBA is their classmates.

“The people are the biggest return on investment,” Rohit says. “The level of conversation is incredibly high. You’re constantly learning from classmates who bring years of experience and different perspectives.”

Ananya agrees. “I didn’t realize how much I would learn just from listening to classmates in class discussions,” she says. “Their real-world examples make the classroom materials and frameworks we learn come alive.”

They’ve also taken full advantage of Wharton’s experiential offerings, including a recent Global Modular Course in Brazil. “In addition to getting to know students across all three cohorts, Wharton curated access to leaders you’d never meet on your own like banking leaders, government officials, and senior executives at some of the top companies in the country,” Ananya says. “It was truly unique.”

Advice for Other Couples

For couples considering the Wharton EMBA together, their advice is simple: go for it.

“It’s 100% worth it,” Ananya says. “It’s a shared experience that helps you understand and support each other through an intense journey. And you still get to build your own individual networks.”

Rohit sees it as a multiplier. “The more you invest in the program, the more you get out of it,” he says. “Doing this together elevates the entire experience and the value we take away.”

By Meghan Laska

Posted: February 13, 2026

Wharton Stories

Wharton Global Youth Program Introduces Learning Sprint in Dubai

“Learning Sprints give [high school] students an opportunity to really understand what it feels like to be in a Wharton classroom and to learn from Wharton faculty,” says Lena Elguindi, senior director of programs for Wharton Global Youth Program.

A priority this year for the Wharton Global Youth Program at the Wharton School of the University of Pennsylvania has been to innovate and improve on the delivery of robust business education programs for high school students.

With a focus on modern finance and private equity, the Global Youth team flipped the calendar year and pursued this goal in earnest with its first-ever Wharton Global Youth Learning Sprint, held in Dubai, United Arab Emirates (UAE).

Wharton professors David Musto and Burcu Esmer guided students in connecting Nobel Prize-winning theories to real-world investing, and introduced core finance principles like diversification, index funds, IPOs, and private equity. Sachin Khajuria, founder and CIO at private investment firm Achilles, delivered a keynote building on the insights from “Two and Twenty,” his book about private markets.

“What a thrill it was to teach alongside Burcu Esmer and Sachin Khajuria,” said Musto, Wharton’s Ronald O. Perelman professor of finance and director of the Stevens Center for Innovation in Finance. “I’m looking forward to seeing our great students again!”

To read the full story, click here.

By Diana Drake

Posted: February 9, 2026

Wharton Stories

Entrepreneurship at Every Stage: How EMBA Students Engage With Venture Lab

“Venture Lab has been the cornerstone of my entrepreneurial evolution. It’s where ideas get pressure-tested and pushed to a higher level,” says Madison Li, WG’26.

Some Wharton Executive MBA (EMBA) students arrive with years of entrepreneurial experience, while others are exploring ventures as a next step. Wherever they are on their journey, Venture Lab serves as a hub, giving Penn students access to mentorship, funding, and a cross-campus network to test ideas, scale ventures, and explore new opportunities. For EMBA students, this means practical, hands-on support that complements their classes and professional experiences.

For Madison Li, WG’26, entrepreneurship has long been central to her identity, with early ventures in 3D printing and consumer electronics. At Wharton, she found Venture Lab to be the connective tissue between classroom frameworks and real-world execution.

“Venture Lab has been the cornerstone of my entrepreneurial evolution. It’s where ideas get pressure-tested and pushed to a higher level,” she says.

Exploring Paths

Venture Lab is built around the idea that there is no single path to entrepreneurship. Under the leadership of Vice Dean of Entrepreneurship Lori Rosenkopf, it offers pathway-based support tailored to different goals:

- Explorer Pathway for those curious about entrepreneurship

- Founder Pathway for students building or scaling ventures

- Joiner Pathway for those seeking to join startups

- Investor Pathway for students interested in funding and acquisition

“Entrepreneurship at Wharton is about value creation through innovation,” says Vice Dean Rosenkopf. “Our goal is to help students develop an entrepreneurial mindset: seeing opportunities before others, assessing viability, and learning how to scale.”

She notes that this approach resonates strongly with EMBA students, who bring deep industry and leadership experience and often want to apply entrepreneurial skills in new ways.

“Execution is usually the limiting factor,” says Dr. Nitin Agarwal, MD, WG’26, who is using Venture Lab resources to launch Novuosis Scientific. “Venture Lab fills that gap by giving you access to experienced advisors, structured feedback, and funding opportunities. It helps turn ideas into executable ventures.”

Open Access Across Campuses and Cohorts

All Venture Lab resources are open to EMBA students across the East, West, and Global cohorts. While in-person programming takes place on the Philadelphia and San Francisco campuses, virtual office hours and select online programming make participation possible from anywhere.

For students not located in Philadelphia, Venture Lab is inclusive, says Madison, who is based in Los Angeles. She points to Scale School, hosted in partnership with Lifelong Learning in San Francisco, as a key resource for founders transitioning from startup to enterprise. “Being able to attend in person or access sessions on demand ensures that learning never stops.”

Madison also joined the VIP-X San Francisco accelerator (VIPX-SF), a competitive program open to both students and alumni that provides stipends, mentorship, and hands-on venture development. “VIP-X brings together faculty, alumni, and founders in a deeply collaborative environment. It’s a uniquely impactful extension of the Wharton experience,” she says.

Finding Co-Founders, Testing Ideas, and Building Momentum

Venture Lab plays a critical role in helping EMBA students find collaborators and refine ideas. Madison met her co-founder, Kenny Sandhu, WG’26, during her first term in the San Francisco cohort. Conversations with classmates sparked the idea behind Koursair, a venture focused on intentional, regenerative travel. A third co-founder, full-time MBA student James Camaliche, WG’25, joined after meeting through Vice Dean Rosenkopf’s Tech in the Bay Area Block Week course.

Frameworks from Wharton courses inform how the team evaluates scalability, constraints, and alignment. “We now apply frameworks from Prof. Gad Allon’s Scaling Operations class to evaluate our venture through the lenses of scalability, constraints, alignment, leadership, and efficiency,” says Madison.

For Nitin, Venture Lab’s Visiting Experts program has been particularly valuable. “Learning directly from founders, investors, and operators helps you avoid common pitfalls and approach entrepreneurship with more discipline and strategic clarity,” he says.

Funding, Competition, and Real Stakes

Venture Lab also provides tangible resources to help EMBA students move from idea to action: coaching, startup tools, and access to funding.

Nitin’s venture, Novuosis Scientific, received a Penn Wharton Innovation Fund award and was named a 2025 Startup Challenge finalist. Madison’s team is participating in the 2026 Startup Challenge.

“The Startup Challenge is the ultimate proving ground,” she says. “It’s a pivotal moment where remote and on-campus students alike can gain visibility, feedback, and funding to bring ideas to life.”

Students interested in investing or acquisition can pursue Entrepreneurship Through Acquisition (ETA) programming, which includes specialized training, webinars, and incubator support. “ETA is a powerful option for experienced professionals,” Nitin notes. “It offers a different but equally entrepreneurial path to leadership and value creation.”

A Cross-Campus, Lifelong Community

One of Venture Lab’s defining strengths is its interdisciplinary reach. EMBA students collaborate with peers across Penn and remain connected to alumni who serve as mentors, speakers, and collaborators. Select programs, such as Scale School and the San Francisco accelerator, are also open to alumni, reinforcing Venture Lab’s role as a lifelong entrepreneurial community.

“The value is unparalleled,” says Nitin. “Having a dedicated hub with real financial and advisory resources and meaningful access for EMBA students is rare.”

What Prospective EMBA Students Should Know

“Interest in entrepreneurship among EMBA students continues to grow as more use the program to explore what’s next,” says Vice Dean Rosenkopf. “Venture Lab complements the EMBA curriculum by offering experiential learning and access to an extraordinary network.”

“The key is engagement,” she adds. “Venture Lab is here to support students. We encourage anyone interested to explore and take advantage of the many resources and opportunities.”

By Meghan Laska

Posted: February 2, 2026

Wharton Stories

Penn Athletics Wharton Leadership Academy (PAWLA) Hosts Annual Coaches Workshop

“Only at Penn can we combine the expertise of faculty from the nation’s top-rated business school with coaches at the forefront of Division I athletics,” says PAWLA Director Amy Coffey. “This collaboration allows our coaches to explore tangible research and practices that inspire stronger performance outcomes.”

The Division of Recreation and Intercollegiate Athletics at the University of Pennsylvania continues to invest in coach leadership development with its annual Penn Athletics Wharton Leadership Academy (PAWLA) Coaches Workshop. A two-day program recently brought together head and assistant coaches — as well as administrators — from across Penn Athletics for an intensive series of sessions focused on communication, leadership identity, motivation, and character assessment.

“The PAWLA Coaches Workshop continues to be one of the most meaningful professional development opportunities we offer,” says Alanna Wren, the T. Gibbs Kane, Jr., W’69, director of athletics and recreation. “Our coaches are committed to growing as leaders, and our partnership with the Wharton School allows us to deliver world-class instruction tailored to the realities of collegiate athletics.”

“Only at Penn can we combine the expertise of faculty from the nation’s top-rated business school with coaches at the forefront of Division I athletics,” says PAWLA Director Amy Coffey. “This collaboration allows our coaches to explore tangible research and practices that inspire stronger performance outcomes. PAWLA continues to be a training ground to witness the fruits of this partnership.”

To read more, click here.

By Penn Athletics

Posted: January 30, 2026

Wharton Stories

Dancing Students Toward Health Care Career Opportunities

“For a class to be memorable, it has to have emotional resonance, which can come from joy, shared struggle, or deep connection,” says Dr. Marissa King, an LDI senior fellow and Wharton School professor of health care management. “There is a science to creating connection, and that is what we do in this course.”

How do dance contests and paper airplane races relate to effectively teaching a health care leadership course at the Wharton School? That question quickly comes to mind upon entering the classroom of Dr. Marissa King as she presides over what can feel like an academic mosh pit: nearly five dozen students in constant motion — dancing, flailing, and shouting encouragement at their chosen teams while the Village People’s “Y.M.C.A.” thunders through the room, loud enough to shake the tables.

“My goal is impact,” explained King, a Leonard Davis Institute of Health Economics (LDI) senior fellow and Wharton School professor of health care management. “As students enter medical school, nursing school, and other health care career paths, they often get bogged down in the technical side of medicine. I want them to remember — and live — the importance of social connection.”

To read more, click here.

By Hoag Levins

Posted: January 23, 2026

Wharton Stories

How Wharton Helped This Marine Accelerate His Career

“The Career Management team was there for every stage: job search strategy, resume, interviews, negotiations – everything. And my executive coach helped me think holistically about what I wanted,” says Neal Ellsworth, WG’24.

When Neal Ellsworth, WG’24, thinks about his career path, he says that it’s never followed a traditional trajectory. After graduating from Michigan State University with a business degree, he wasn’t drawn to corporate life. Instead, he wanted something that would test him physically, intellectually, and globally. That turned out to be the U.S. Marine Corps.

As an infantry officer, Neal deployed to Australia where he first learned about special operations missions. Soon after, he became a Special Operations Officer with the U.S. Marine Corps Forces Special Operations Command (MARSOC), completing multiple overseas deployments. Graduate school, he thought, wasn’t in the cards.

But after returning from deployment, a fellow veteran changed his perspective. “He advised that an MBA from a top-tier program could help me transition to the private sector,” Neal notes.

That encouragement sparked a new chapter. Conversations with veterans several years ahead of him helped Neal see graduate business education as not just possible, but potentially transformational. And when he began exploring programs, Wharton rose to the top.

“The veterans community at Wharton welcomed me even before I applied,” he explains. “They shared their experiences, helped me understand the process, and made me feel like I already belonged. That sense of community was a huge factor.”

Neal was accepted into Wharton’s full-time MBA program in 2020, but his career took an unexpected turn when he was selected to serve as a liaison to the House Armed Services Committee, an opportunity he couldn’t pass up. While working on Capitol Hill, he learned about Wharton’s MBA Program for Executives and realized it was the perfect fit.

“A friend encouraged me to consider the Executive MBA because I had a decade of experience, and I’d be learning alongside other mid-career professionals,” he explains. “It felt like the right move.”

Neal began Wharton’s EMBA program while still on active duty, finishing his final months on the Hill. After leaving the military, he joined Vannevar Labs, a venture-backed defense technology startup.

He recalls, “It was an amazing experience getting real-time exposure to a high-growth company while learning the business frameworks behind everything we were doing.”

Strategic Career Advising at Every Step

As Neal began exploring long-term career options, he turned to Wharton’s EMBA Career Management team for guidance.

“They were there for every stage: job search strategy, resume, interviews, negotiations — everything,” he says. “And my executive coach helped me think holistically about what I wanted.”

The career team helped him build a detailed spreadsheet to assess roles, industries, and compensation, an exercise that proved especially valuable for someone transitioning from the military, where salary structures are public and standardized.

“In the military, there’s no negotiating your pay,” explains Neal. “Having to assess my market value was completely new. They helped me understand not only what I was worth today, but how to think about the long-term trajectory of each opportunity.”

That preparation paid off. As he transitioned from the military, Neal was fielding three strong offers — each with different strengths. With the help of Wharton’s career team, he negotiated confidently and ultimately chose defense tech.

Lifelong Support for Alumni

Neal spent several transformative years at Vannevar Labs as a business unit leader, helping the company scale from 40 to 280 employees. He built one of the company’s business units from the ground up, an experience he describes as “an MBA in action every single day.”

Recently, Neal was ready to explore a new challenge. This time, he approached the job search with more precision, leveraging the frameworks and tools developed during his time at Wharton.

Neal also turned to Wharton’s Career Management team, which offers alumni lifelong support. “I met with my Wharton executive career coach regularly,” he says. “In the end, I received four offers; having that amount of choice is amazing. I’m so grateful that this level of career coaching continues for alumni.”

Leveraging the Full Power of Wharton Resources

So, what exactly did Neal utilize as a Wharton student and alumnus to accelerate his career?

He breaks it down:

One-on-one Executive Coaching

“Consistent sessions helped me refine my goals, prepare for interviews, and negotiate offers with confidence.”

Career Data and Frameworks

“The tools provided, particularly the compensation and role-mapping spreadsheet, still guide my decisions today.”

The EMBA Job Board

“The EMBA job board focuses on mid-career roles, not just entry-level MBA positions. And because I was in the EMBA program, employers treated me as a highly experienced full-time professional making a transition — rather than a student.”

The Wharton Network

“From defense-tech leaders to classmates in gaming, media, tech, and energy, I used Wharton’s network to explore industries I had never considered before. The willingness of people to talk with me was incredible.”

Classmates

“The diversity of experience in Wharton’s EMBA program was eye-opening. In the military, career paths are linear. At Wharton, I realized you can take your career in so many directions.”

A Transformational Experience

“Wharton changed the trajectory of my career,” says Neal. “The classes, especially Prof. Kevin Kaiser’s Valuation, shaped how I think about value creation, strategy, and opportunity cost. I use those lessons every day, for both business decisions and personal career decisions.”

When asked what advice he would give current or prospective EMBA students, Neal keeps it simple: “Jump in and use the resources. Even if you’re not planning a transition now, you will eventually. Wharton gives you the tools, but you have to use them.”

By Meghan Laska

Posted: January 19, 2026

Wharton Stories

How the Wharton AI & Analytics Accelerator Helped Penn Vet Turn Data Into Action

“It was really powerful for our leadership to see that we brought a real problem to the students, and they came back with something tangible,” said Sarah Trout, associate director of Penn Vet Advancement Services.

When Penn Vet joined the Wharton AI & Analytics Accelerator, the goal was clear but ambitious: make better use of years of client and hospital data to strengthen engagement, fundraising, and long-term strategy. For Chase Engel, assistant director of Annual Giving, and Sarah Trout, associate director of Penn Vet Advancement Services, the Accelerator offered a rare opportunity to step back from day-to-day operations and ask deeper, data-driven questions about how Penn Vet connects with its community.

“We’ve always known we have a lot of data,” Trout said. “But we didn’t have the tools or resources to really analyze it in a way that could change how we work.”

Through the Accelerator, an experiential learning program run by the Wharton AI & Analytics Initiative (WAIAI), Penn Vet partnered with a multidisciplinary team of Wharton and Penn students who worked directly with the organization’s real-world data and business challenges.

To read more, click here.

By the Wharton AI & Analytics Initiative

Posted: January 16, 2026

Wharton Stories

How Wharton Is Helping This Heart Surgeon Expand Her Impact Beyond the Operating Room

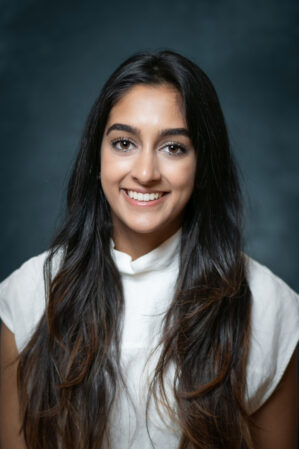

“I now understand how hospitals run from a business perspective. I can speak the language. That changes everything,” says Dr. Sarah Minasyan, MD, WG’23.

Why would a successful cardiothoracic surgeon get her MBA at Wharton? For Dr. Sarah Minasyan, MD, WG’23, the answer traces back to a Russian saying she grew up with: “Live 100 years, learn 100 years.”

Her path to Wharton — and to the operating room — was shaped long before medical school. Raised in the former Soviet Union, she experienced political and personal upheaval in her teenage years. After the fall of the Iron Curtain, the country she had been taught to trust began to crumble. During that same period, she lost her father to brain cancer.

Her mother, recognizing both the shifting political landscape and the need for a different future, made the life-altering decision to leave. It took six years and a complex web of bribes, but they finally received permission to emigrate. “When we left, we had almost nothing,” Sarah recalls. “My parents were scientists, and the most expensive things in our home were books.”

In the U.S., she accelerated quickly, learning English, graduating valedictorian, and earning her undergraduate degree from UCLA. Her interest in medicine stemmed from both practicality and inspiration.

“Living in Russia, I saw how the world can quickly change,” she says. “But the human body does not change. If I ever needed to start over in another country, I could continue practicing medicine because it is universal.”

As for inspiration, a family friend who was a renowned congenital cardiac surgeon “walked on water” in the eyes of her community. Watching a highly respected master surgeon at work sealed her career choice of cardiothoracic surgery.

Recognizing a Knowledge Gap

For years, Sarah thrived in high-stakes surgical environments. But over time, she observed a growing challenge. Physicians and

administrators, she realized, often spoke two different languages. “Hospital administration spoke business, and I didn’t understand that language,” she says. “Yet as a surgeon, you work within complex systems. You have to engage with the business side whether you intend to or not.”

When the COVID-19 pandemic hit, the mother of four saw both a crisis and an opportunity. “I realized this was the time to learn the language of business,” she says. “And if I was going to do it, I wanted to learn from the best.”

Her husband, also a surgeon, helped her research programs. When they saw that Wharton offers a San Francisco cohort, the decision was made. She applied only to Wharton. “It was an investment in myself. Go big or go home.”

Stretching to Meet a New Challenge

Sarah entered Wharton with an MD and years of surgical leadership, but she describes her early coursework with humility: “Many of my classmates were engineers or deeply immersed in the business world. I had so much catching up to do.”

Her classmates quickly became a source of support, especially during weeks when she was juggling major surgeries and exams. “I’ve operated in teams my whole career, but this was a new kind of team. It was phenomenal,” notes Sarah.

Sarah also came to appreciate how her clinical background offered unique value. She explains, “Surgeons make critical decisions with limited information every day. That translates directly into business leadership. I didn’t realize how relevant that instinct was until Wharton.”

Global Perspective and Applied Impact

Although COVID canceled her planned Global Business Week in Sweden, Sarah refused to let the opportunity disappear.

Instead, she designed her own independent study and traveled there anyway, with Prof. Guy David (Alan B. Miller Professor; Chair, Health Care Management Department) advising her project. She used the Wharton network to connect with Swedish health leaders and investigate why Sweden’s heart failure readmission rates in rural areas are dramatically lower than those in the U.S.

Her findings were illuminating: remote monitoring, telehealth, and mail-in labs formed the backbone of Sweden’s success. “The prototype is there,” she notes. “Adopting similar models in the U.S. would require policy changes, but it’s possible — and it would save lives and reduce costs.”

Following graduation, Sarah was recruited by Utkars Jain, WG’27, to the clinical advisory board of HEARTio, an AI startup aiming to address one of the biggest bottlenecks in emergency medicine: rapid triage of chest-pain patients. “If you can accurately triage patients early, you free up beds, reduce costs, and improve outcomes. It aligns perfectly with my expertise and Wharton’s emphasis on operational impact,” she says.

The Value of a Wharton MBA

For Sarah, the value of the Wharton MBA is about opening new worlds:

- Career relevance: “I now understand how hospitals run from a business perspective. I can speak the language. That changes everything.”

- Expanded networks: “You open a new world for yourself from CEOs and innovators to policymakers. The Wharton brand opens doors.”

- Family benefit: She often jokes that the degree is also an investment in the next generation because the network benefits her kids as well as her classmates’ children.

- Personal growth: “You keep on learning. You stay curious. That matters.”

“Consider it an investment in yourself and in your future influence,” she says. “If you want to lead, if you want a seat at the table, you need the knowledge and confidence to speak the language of business. Wharton gives you that and more.”

By Meghan Laska

Posted: January 5, 2026